For much of the past month, investors have been fixated on the Dow Jones Industrial Average’s quest for its first print above 20,000, which it finally crossed on Wednesday.

During the Dow’s rally, which has amounted to more than 8% since the US presidential election, a lot of focus has been placed on which stocks could propel the index over that big round number. That is because the average is heavily dependent on the moves of individual stock prices, and it actually exposes a big criticism in the way the Dow continues to be touted as a benchmark for the whole market.

Because the Dow is a price-weighted average, the higher a specific stock is priced, the bigger the impact it has on the benchmark’s price.

The Standard & Poor’s 500 index is weighted by market cap, meaning that the bigger the size of a company, the bigger its impact on the index.

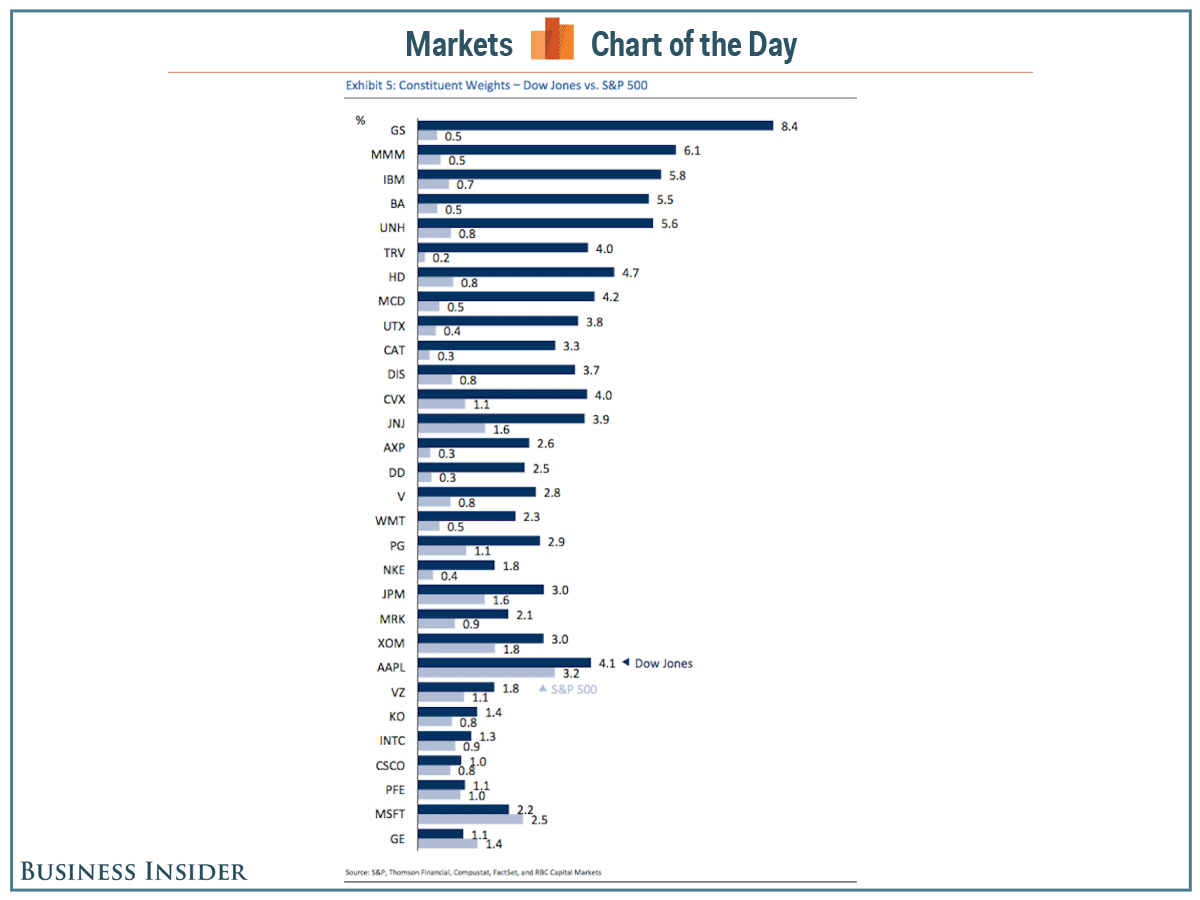

For example, while Goldman Sachs is the highest-priced stock in the Dow at $244.30 and accounts for 8.4% of the index, the bank carries only a 0.5% weighting in the S&P 500. Goldman has gained about 35% since the election and has been a big reason behind the Dow’s approach to the 20,000 level.

General Electric, which is among the lowest-priced stocks in the Dow at $31.36, carries a 1.1% weighting in the Dow and a 1.4% weighting in the S&P 500.

In the same period in which the Dow has risen by 8%, the S&P 500 is up by about 6%.

The chart shows the weightings of the 30 Dow Jones components versus their weightings in the S&P 500.